Helpful! Why Are Commodity Prices So Low

2 A change in raw material and other operating costs. The USDA forecast of 663 billion in income last year was half of the 2013 peak and a reflection of persistently low commodity prices.

Investor Alert U S Global Investors Periodic Table Economics Iphone Cost

Longer-term sugars supply surplus will eventually push prices so low that production takes a hit.

Why are commodity prices so low. Near-perfect growing conditions brought a record harvest last year and another bumper yield is predicted for 2015 so surplus grain has kept commodity prices low. Get the Services Support and Advice That You Expect. Bad weather can wreck agriculture supply and cause prices to rise.

For some businesses a change in commodity prices directly affects sales revenue. Prices are low because of government programs he said. Falling Commodity Prices Are a Big Reason Why Inflation Is So Low John Murphy June 16 2017 at 0656 PM Ever since Wednesdays Fed rate hike and the press conference by Janet Yellen Ive been thinking a lot about inflation.

Oil price doesnt reflect the natural supply and demand forces that normally determines a commodity price. Dollars so it may seem intuitive that when the dollar rises commodity prices will decrease. Dec 15 2014 Jeffrey Frankel.

Innovation in farming equipment can cause agriculture prices to fall. Hence in the case of an economic crisis commodities prices follow the trends in exchange rate coupled and its prices decrease in case there are downward trends of diminishing money supply. It may seem odd that something can have two prices at once.

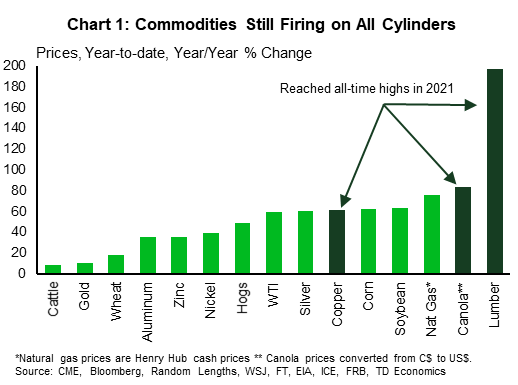

1 An effect on sales revenue. That has dragged silver 115 lower to USD 221460 an ounce and an already fragile gold lower by 045 to USD 174660 an ounce after finishing unchanged at USD 175500 an ounce on Friday. Lumberthe form of wood that builders use to build and renovate homeshas been the talk of the town due to the massive increase in its price.

Commodity Spot Price vs. All-weather fund that performs well in all market environments. The rate of return on investment is.

The CBO outlook focused on farm subsidy costs said corn would stay below 4 a bushel for the decade to come and soybeans would not top 9 a bushel until 2023. Dollar will impact inflation through. The advent of a crisis will pull commodities prices down.

When the President of the United States released oil from the strategic petroleum. Because commodity reserves exist in specific areas of our planet political issues in one region often affect prices. He contends that the theory that farmers have to have help because commodity prices are too low is wrong.

About half of the agricultural sector relies totally on the market for income. However supply continues to outweigh demand. Why are commodity prices increasing.

Commodities are Mispriced Prices go through periods of high and low valuations based on supply availability and demand for goods. The US economy is running hot owing to massive federal stimulus and a waning coronavirus pandemic even factoring in the recent surge in cases due to the Delta variant and that has caused demand for goods and services to outstrip the ability of companies to supply. Experience When It Matters Most.

Lower consumer prices might also factor into weaker wage growth pressures which are already at historic lows. That sector has no greater variation in income than the sector that is covered by farm programs. Why are commodity prices so low.

Most dollar commodity prices have fallen since the first half of the year. While the price effects are largely self-explanatory the limited windfall for real activity at least in the near term is perhaps a little surprising. Foreign exchange impacts commodities prices and so does money supply.

Or in the case of the. If demand does not grow proportionally the price decreases. Though a host of sector-specific factors are at work the fact that the downswing is so broad as is often the case with large price movements suggests that macroeconomic factors are at work.

CAMBRIDGE Oil prices have plummeted 40 since June. A stronger greenback also tends to lower commodity prices including those for sugar he adds. It hit a record low in July but has since recovered about 25 thanks to a reduction in exports from Brazil and Australia.

Ad How this fund did well in bull and bear markets. Traditionally gold has been viewed as a safe haven for investors but analysts are watching carefully to see how prices. The precious metal has slipped 9 this year and is on track for its third year of losses.

Platinum and palladium have been pummelled today in a broad commodity sell-off tumbling by 350 and 350 respectively. This base metal has done better than other commodities over the past few months. As materials can be harvested mined or gathered more efficiently they become cheaper to produce and supply grows.

Simply a stronger US. As for other commodities they generally are tied to their own unique supply and demand constraints. Take the example of a dairy farmer whose revenue is directly linked to the.

As an example when Iraq invaded Kuwait in 1990 the price of crude oil doubled in the weeks that followed on the nearby NYMEX and Brent crude oil futures contracts. The commodity markets are quoted in US. WHY ARE PRICES SO LOW.

But its quite common in the world of commodities tradingEvery commoditya. This is in stark contrast to 2019 when lumber prices were so low that some sawmill owners were better off ceasing operations. Ad Experience When It Matters Most.

A change in commodity prices has too main possible effects on a business. The argument goes that as prices fall the producer needs to produce more to cover costs and gets into a death spiral where producers produce more and more of the commodity until the price collapse.

Keltner Channel Overbought And Oversold Signals Technical Analysis Indicators Trading Charts Technical Analysis

Steel Demand May Grow In East Asian Markets Iron Ore Price Chart Iron

Coronavirus And Commodity Markets Lessons From History

Don T Let Lower Commodity Prices Stop You From Making A Wise Investment In Your Dry Fertilizer This Fall Infographic A Investing Invest Wisely Plant Science

This Is The Best Time To Get Your House In Order Change Management Risk Management Energy Management

Oil Below 37 As Record United States Inventories Overshadow Output Freeze Plan Mytechbits Crude Crude Oil Oil And Gas

Why You Should Consider Commodities Kiplinger

The Significance Of Rising Commodities Prices Commodity Prices Significance Risen

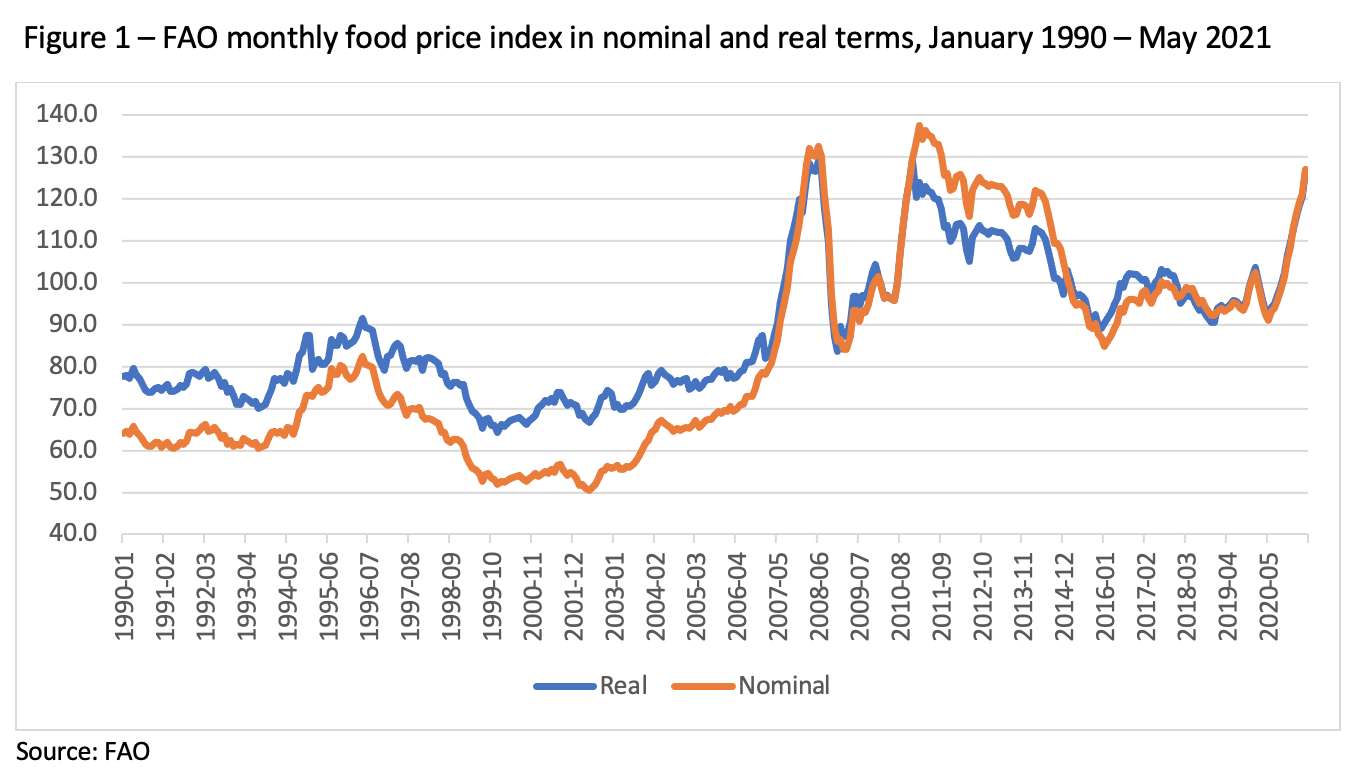

Rising Food Prices Are A Concern But No Reason For Panic Yet Ifpri International Food Policy Research Institute

Commodity Price Report Temporary Imbalances Are Driving The Commodity Rally

Saudi Vision 2030 Challenges Opportunities Challenges And Opportunities Green Cards Visions

You Ve Probably Thought About How Futures And Options Are Not The Same As One Another Did You Options Trading Basics Options Trading Strategies Option Trading

On America S Farms Worries About Regulation Hope For Trade Deals Under Biden Commodity Prices Agriculture Industry America

/dotdash_INV_final_Commodity_Prices_And_Currency_Movements_Jan_2021-01-01e52191cf9e4cfa9bdd56851f2ef184.jpg)

Commodity Prices And Currency Movements

Integrated Oils Break Even Prices Integrity Dividend Operating Expense

Post a Comment for "Helpful! Why Are Commodity Prices So Low"