Beautiful! Why Is My Gross Pay And Taxable Pay Different

Its Gross Salary not taxable salary then. Said another way earnings stack upon earnings as the year goes on much like an inverted pyramid.

Teks 5 10b Taxes Personal Financial Literacy With Project Personal Financial Literacy Financial Literacy Net Income

Gross means the salary before tax and net salary means the amount we get in the bank account after any deductions like taxpensionstudent loanscar loan or what ever.

Why is my gross pay and taxable pay different. Yes my tax code has been 65L since April in June I paid 49247 income tax on my salary of 280058 this month just got my payslip today it was 527 on the same gross salary same tax code nothing else changed but means my net pay is 35 less than last month I have phoned my HR dept and left a message for them to get back to me and. The figures for pay and tax on your P60 should be the same as taxable pay and tax to date shown in the bottom right hand corner of your March payslip. You must use gross wages to calculate your employees net wages.

Total Deductions Details total of all Deductions 19. These deductions can include federal state and local taxes as well as contributions for Medicare and Medicaid elected health insurance. Gross wages are the total amount your employer paid you before taxes or other deductions.

Add Employer Paid Benefits Taxable for QDP Medical and Dental YTD. This is the difference between total Pay. Your gross pay may equal your taxable pay but sometimes your taxable pay is less because of pre-tax exemptions or deferred compensation.

The two might diverge if you divert some of your gross pay to non-taxable benefits such as pension contributions or childcare vouchers or conversely if you have taxable non-cash benefits like medical. This means you may have several tax rates that determine how much you owe the IRS. The gross income on your paycheck obviously includes only what you earn from work but on your tax return youll typically have to include income from all other sources as well.

In other words net pay equals gross pay minus the relevant deductions that are made from an employees wages. Why is the taxable amount the same as the gross amount. Your gross pay is all of your compensation and your taxable pay is the amount from which taxes are deducted.

Chapter 3 of the Employers Guide to PAYE details the different types of pay that would be included. Why your net pay is the number you should really care about Gross pay is a somewhat useful figure as it gives you an overall idea of how much money youre earning from your. Gross Pay this is your total earnings including expenses prior to any deductions.

Gross pay is not the amount you pay your employee. Chapter 3 of the Employers Guide to PAYE details the different types of pay that would be included. Gross pay is the employees pay of any kind including.

Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. Personal Retirement Savings Account PRSA Retirement Annuity Contract RAC. Your personal allowance will be taken off as part of calculating the amount of tax due on that.

Taxable pay is your gross pay less any contributions you make to a. Taxable pay is the entire amount that might be subject to tax. Your P60 shows the amount of your taxable pay that is to say your gross pay less any pension contributions which are tax free.

Gross income includes all income you receive that isnt explicitly exempt from taxation under the Internal Revenue Code IRC. This is the way its supposed to work. The difference between gross pay and net pay is that net pay represents the actual amount a person receives on their paycheck each period.

However if you. Gross pay is the amount you owe employees before withholding taxes and other deductions. Taxable Pay this is your gross pay less any deductions which attract tax relief these deductions include pension.

Taxable income is the portion of your gross income thats actually subject to taxation. Revenue approved Permanent Health Benefit Income Continuance scheme. By contrast net pay is the amount left over after deductions have been taken from an employees gross pay.

Gross Income Versus Federal Taxable Gross. Taxable pay is your employees gross pay less any contributions the employee. My annual gross was X 13 at that time.

If your salary is 30000 per year then your gross pay is 30000 plus any bonuses overtime pay or awards. So I understand that the net pay is the gross pay subtracted with tax and NI but I have some doubts on how these are calculated since I get different results in salary calculators online where the taxable amount is lower than the gross. Deductions are subtracted from gross income to arrive at your amount of taxable income.

UKBA takes the Gross Salary amount in to consideration not the Net Salary one. Revenue approved pension scheme. The Social Security Wage Base for 2019 was 132900.

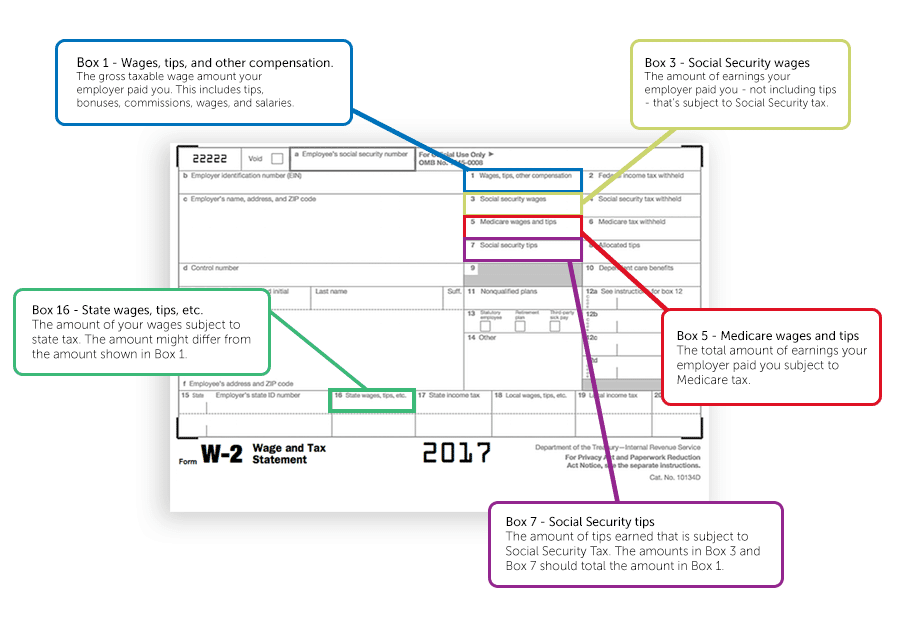

To determine Social Security and Medicare taxable wages on your W-2 again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable. Net Pay Details Net Pay take-home pay. If youre an employee the money you earn your salary or hourly wage is called your gross pay.

Net pay is the amount you give to your employee. The employees pay before any pension contributions or salary sacrifice deductions are made. Net pay is what an employee takes home after deductions.

Gross income is the total amount of income you bring in while federal taxable gross is the amount of your income subject to federal income tax. Taxable pay is usually less than gross pay. Gross pay also called gross wages is the amount an employee would receive before payroll taxes and other deductions.

Taxable Pay Taxable pay is Gross Pay minus any tax-free elements eg. Total Pay Details total of all Pay and Allowances 17. Taxable wages may be adjusted to lower your tax liability.

When deductions from gross pay Tax and National Insurance Contributions have been deducted the amount you receive is called your Net Pay. You can see what your gross pay was and how much has been taken off if anything on your payslip.

Gro And Net Income Taxes Financial Literacy Teks 5 10 A 5 10 B

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Federal Income Tax

Did You Know There Was Medical Tax Deductions Available To You Healthcare Savemoney Business Tax Deductions Tax Deductions Tax Help

Pay Day Show Me The Money Gross Income And Net Income Teks 5 10b Net Income Show Me The Money Income

Small Business Daily Payroll Tracker Ledgers For Hourly And Etsy Payroll Template Payroll Lettering

Tax Formula Tax Deductions Tax Above The Line

/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

Taxable Income Vs Gross Income What S The Difference

How To Sell Online Payslips To Your Employees Payroll Payroll Template National Insurance Number

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Tax

Taxable Income Vs Gross Income What S The Difference

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief

Net Vs Gross Income Anchor Chart Financial Literacy Financial Literacy Lessons Economics Lessons

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Finance

Understanding Income Tax Income Tax Tax Deductions Tax Services

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Mana Net Income Debt Relief Programs Credit Card Debt Relief

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross And Net Income Personal Financial Literacy Financial Literacy Lessons Financial Literacy Anchor Chart

Post a Comment for "Beautiful! Why Is My Gross Pay And Taxable Pay Different"