WOW..Why Did My Tax Refund Get Reduced

Then that takes it right back down to no refund he said. If you receive a large refund try increasing your allowances on your W-4.

New Tax Rule Could Mean Bigger Tax Refunds For Some Families But Only If They Re Savvy

We do not have any information about.

Why did my tax refund get reduced. A reference code and contact number will be provided. However my AGI married filing jointly is significantly less than the income limit of 150000. We reduce or take an income tax refund for child support only when directed to do so by the Illinois Department of Healthcare and Family Services HFS.

I havent met a person yet whos return hasnt been compromised by the stimulus deduction of which I and many others would or should have thought would have been added to the gross income not the adjusted and certainly not the final Refund itself. Then that takes it right. However if you did receive the stimulus money already once you enter that amount on your tax forms it will change your refund or what you owe.

If youre surprised by a tax refund that is less than expected in 2020 or 2021 not sure why your tax refund was reduced or the complexity around taxes has got you stressed HR Block is here to help. If your clients refund has been offset it may be have been reduced by BFS to pay. You can file your return and receive your refund without applying for a Refund Transfer.

When you get a tax refund that is different from the amount you expect its important to be very deliberate about every step you take. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. The taxpayer can also contact the agency for which they have.

Through March 26 the IRS has received 85 million individual income tax returns and processed 7597 million. The fastest way to get a tax refund which will include your 2020 RRC is to file electronically and have it direct deposited into their financial account. Answer 1 of 14.

But wait they suddenly realize they did get the 2400 so they enter that information on their tax forms. There are several reasons why your refund may not match the Wheres My Refund. If you received any stimulus check or got a direct deposit of economic impact payments EIP or through a stimulus EIP Debit card a question may hover if the payment will actually increase your tax or reduce your expected tax refunds during the year 2021The plain and simple answer to that question is that stimulus payments are tax-free.

To find out why Healthcare and Family Services told us to offset your refund contact them by calling 1-800-447-4278 or 217 785-1692. Heres how to get to the bottom of the problem and how to make sure you dont make the problem any worse. Bank accounts many prepaid debit cards and several mobile apps can be used for direct deposit.

Check For the Latest Updates and Resources Throughout The Tax Season. If a correction is needed there may be a slight delay in processing the return. Why does my stimulus payment reduce my refundincrease my amount owed.

By itself after you receive notification of an offset. All or part of your refund may have been used offset to pay off past-due federal tax state income tax state unemployment compensation debts child support spousal support or other federal nontax debts such as student loans. I E-filed my taxes on February 2 2021 using TurboTax Home and Business.

If they are getting a refund the refund will get. Why is my refund different than the amount on the tax return I filed. If your refund was reduced to satisfy a Virginia Tax debt and you have any questions or disagree with the bill please contact Collections at 8043678045.

However the listed balance of your refund may not take into account all offsets your tax return has accrued. Minimize your tax liability as much as possible. The refund reduced 1200 from the TurboTax calculated refund just appeared in my bank account marked Pending March 10.

Use last years tax return as a road map for this years taxes. The IRS Wheres my Refund tool may show that your federal tax refund was offset for a past due obligation. If a refund has been offset to pay any of the items above the Wheres My Refund tool at irsgov will indicate that the amount has been reduced.

If you pay more taxes than you owe during the year you may receive a tax refund. If the tax refund you received was not as much as you expected it may have been reduced by the IRS or Financial Management Service FMS as an offset to pay. Keep more of your money throughout the tax year so you have more money to invest.

Understand your tax responsibilities. If the offset is for a debt owed to another agency please contact the agency collecting the debt which will be listed in the notice you receive. Personally I didnt need a 60000 loan last year but the gift.

A qualifying expected tax refund and e-filing are required. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. Refund Transfer is a bank deposit product not a loan.

Thanks for your response. However a change in any one of these factors can cause your tax refund to decrease. Based on your entries for the stimulus payment amounts filing status and dependents the program will automatically calculate the amount of credit due to you and enter the amount on line 30.

Certain unemployment compensation debts owed to. We can help you file your taxes check your withholding and understand your lower tax refund. When your tax rate deductions payments withholding and income remain the same from year to year your refund usually stays the same too.

The first reason would be that the refund is subject to an offset. What Causes a Tax Refund to Decrease. With your original joint tax return Form 1040 or Form 1040-SR With your amended joint tax return Form 1040-X or.

When filing a Form 8379 with your joint return by mail or with an amended return write Injured Spouse in the top left corner of the first page of the joint return. The stimulus payment is not added to your taxable income on your return. Refunds are nice but surprises arent always as pleasant.

Pastdue child support Federal agency nontax debts state income tax obligations or. When this happens it means that the IRS doesnt agree with the 1040 you sent in.

3 Reasons You Shouldn T Receive A Tax Refund Next Year Gobankingrates

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Why Is My Tax Return So Low In 2021 H R Block

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Top Reasons Your Tax Refund Could Be Delayed Turbotax Tax Tips Videos

Still Waiting On Your Tax Refund Here Are Some Options For You Cbs 17

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

Average Tax Refund In Every U S State Vivid Maps Tax Refund Map United States Map

Do The Math Understanding Your Tax Refund Turbotax Tax Tips Videos

Tax Refund Schedule 2021 When To Expect Your Tax Refund

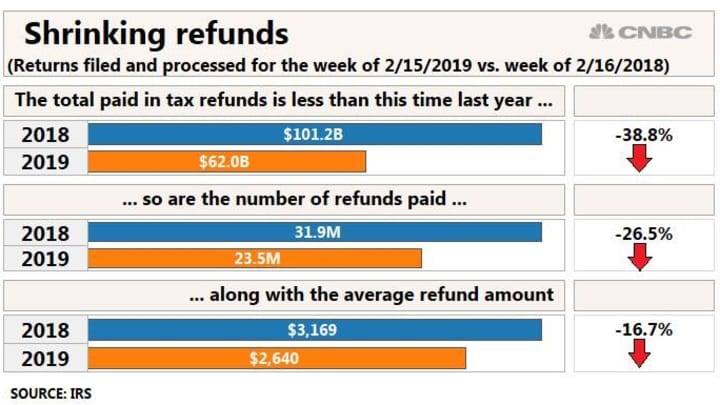

Here S Why The Average Tax Refund Check Is Down 16 From Last Year

Still Waiting On Your Tax Refund Here Are Some Options For You Cbs 17

Smaller Tax Refund This Year Here Is Why And How To Fix It Next Time

Can My Tax Refund Be Garnished The Official Blog Of Taxslayer

Are You Nervous About Filing Or Haven T Filed In Past Years Because Of A Refund Offset A Refund Offset Is When An Irs R Income Tax Child Support Student Loans

Best Tips For Lowering Your Property Tax Bill Tax Refund Tax Time Tax Lawyer

Where S My New York Ny State Tax Refund Ny Tax Bracket

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Post a Comment for "WOW..Why Did My Tax Refund Get Reduced"