Gorgeous! Why Is Apr Higher On Arm Loans

When it comes to your mortgage it is calculated using your interest rate broker fees closing costs and all other charges that are required to finance the loan which is why the APR is usually higher than your interest rate. Find and Compare Refinance Rates.

Apr Vs Interest Rate Understanding The Difference Credible

Ad Compare Lowest Mortgage Refinance Rates Today For 2021.

Why is apr higher on arm loans. No SNN Needed to Check Rates. Be careful when comparing the APRs of fixed-rate loans with the APRs of adjustable-rate loans or when comparing the APRs of different adjustable-rate loans. Ad Get A Low Rate On Your ARM Today.

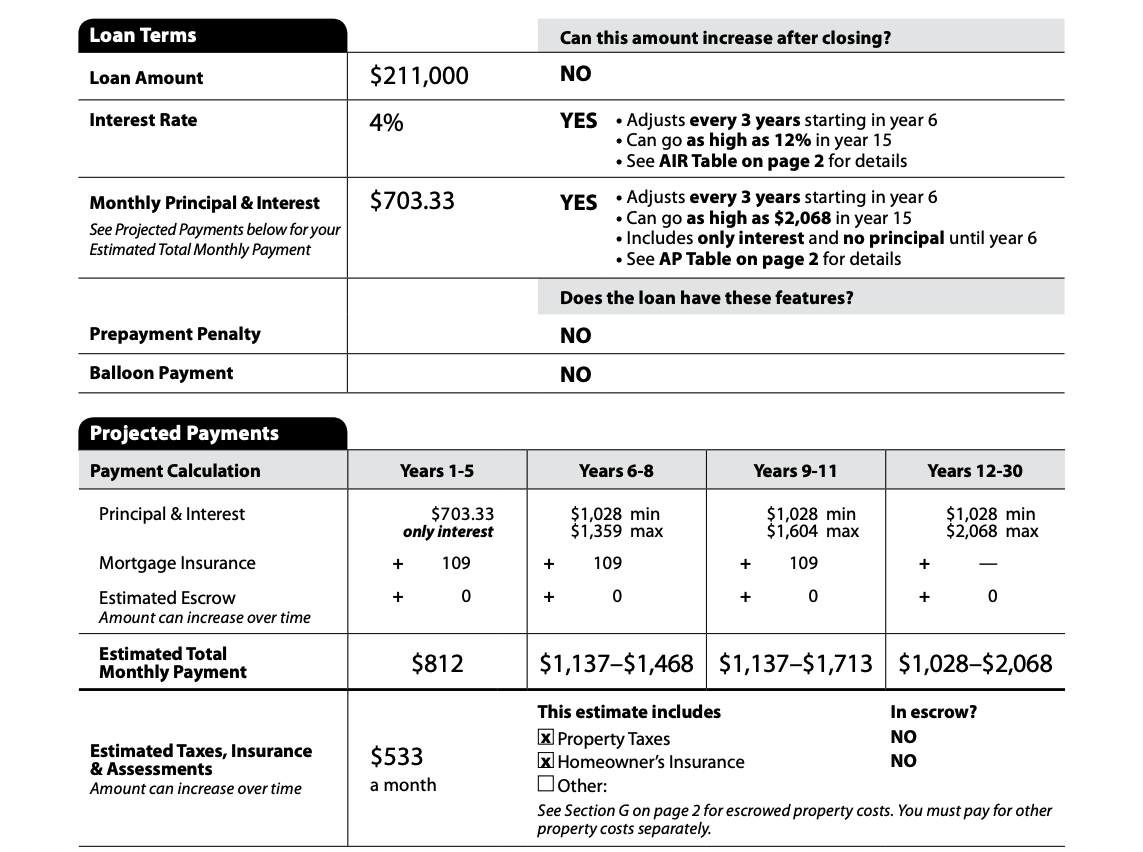

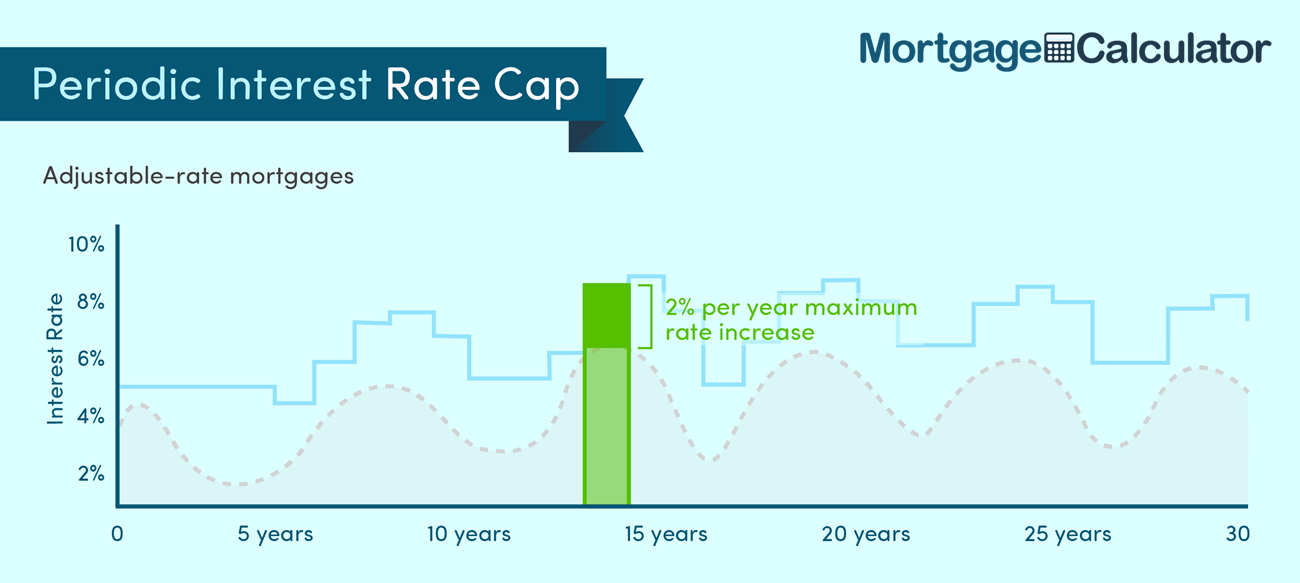

Be careful about comparing the APR of a closed-end loan which includes fees to the APR. If you pay your loan off early the actual APR youll pay is higher. For adjustable rate mortgage loans the APR does not reflect the maximum interest rate of the loan.

When calculating APRs on adjustable rate products you must look at your initial interest rates to determine your course of action. We Strive to Provide the Lowest Rates. If you pay off a 30-year loan after seven years for example a lower APR may not be as helpful as youd like.

Ad Fixed Mortgage Refinance Rates for 15 30 Years. We Strive to Provide the Lowest Rates. Will make the APR higher than the current rate.

No SNN Needed to Check Rates. Low Fixed Mortgage Refinance Rates Updated Daily. Get Competitive Rates That Work Within Your Budget.

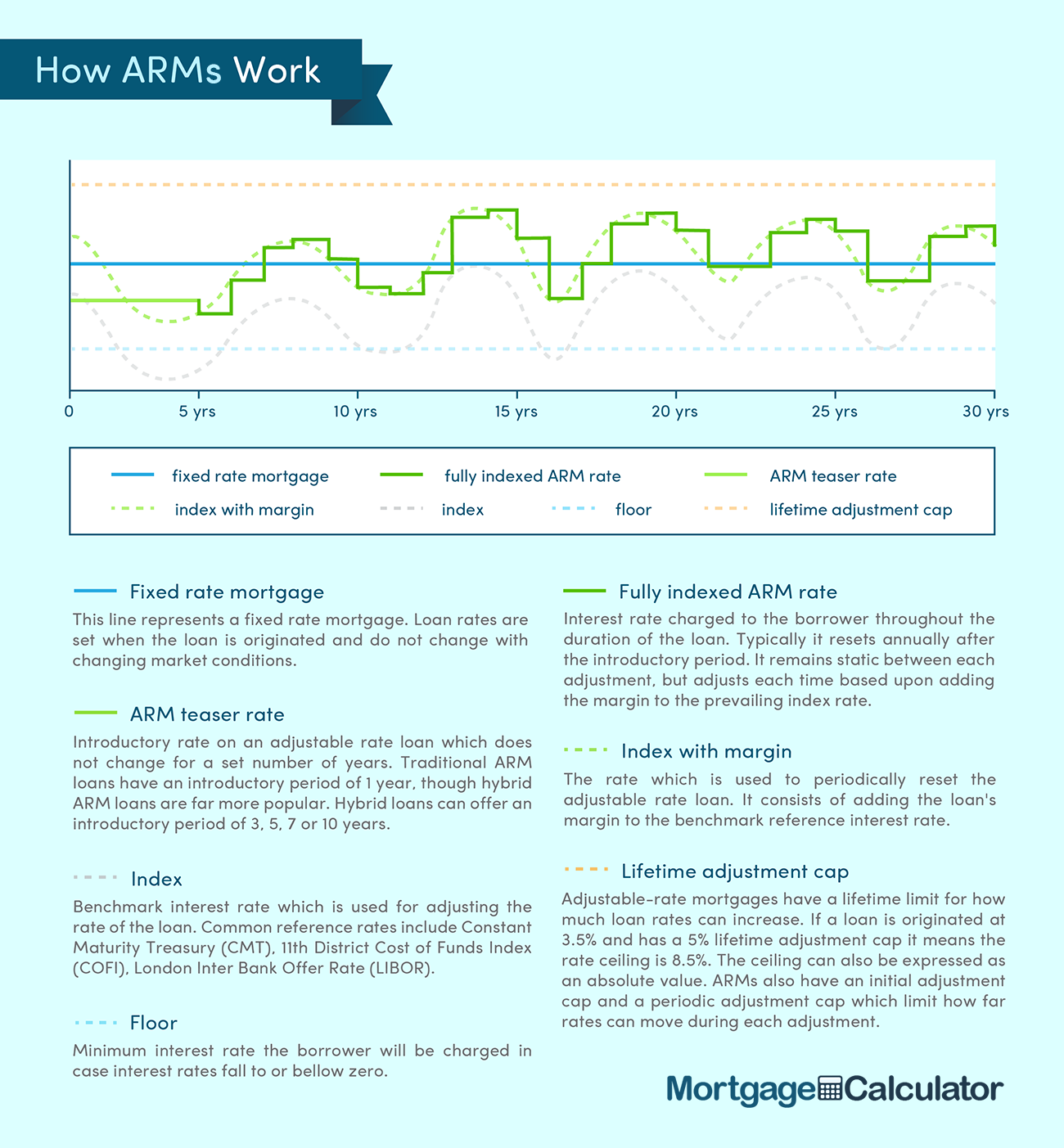

An adjustable-rate mortgage or ARM is a home loan with an interest rate that can change periodically. Wells Fargo is giving me Im comparing loans before I pay and do the final app 3625 but their APR. APR or annual percentage rate is a calculation that includes both a loans interest rate and a loans finance charges expressed as an annual cost over the life of the loan.

Were Americas 1 Online Lender. ARMs first burst on the scene in the early 80s a period of very high. Why is my APR so much higher than the interest rate.

As Blue said in APR the interest rate is reflected including points and associated fees. Ad Find Out Why AmeriSave Has Financed 390000 Homes. The APR or annual percentage rate is the cost you incur for borrowing money.

The Best Lenders All In 1 Place. Ad Compare 2021 top lenders to get matched with lenders curated for your needs in 2 minutes. Get Terms That Meet Your Needs.

Explore Options for 5 7 and 10 Year ARM Rates. Youll probably pay more upfront costs to get a low APR and seven years of a lower APR might not offset the high closing costs. Ad The Best Way To Find Compare Mortgage Loan Lenders.

Compare ARM Mortgage Rates More. It is for this reason the APR is always higher than the interest rate of the loan and the financed amount is lower than the loan amount. Over 15 million customers served since 2005.

This option typically presents a high APR because the maximum amount of payments on the loan will be at the highest rate. Chase is giving me 35 on my home loan to close next month. Comparisons Trusted by 45000000.

In other words. Ad Find Out Why AmeriSave Has Financed 390000 Homes. Ad Compare Lowest Mortgage Refinance Rates Today For 2021.

Compare ARM Mortgage Rates More. For instance the APR calculation for a 31 LIBOR ARM assumes that after the first three years the loan increases to its fully-indexed rate or rises as high as its allowed to under the loan. In calculating an APR therefore some assumption must be made about what happens to the rate at the end of the initial rate period.

Using our same logic from above but taking a fully-indexed rate that is higher. The 6 interest rate is then used to calculate a new. Explore Options for 5 7 and 10 Year ARM Rates.

Annual percentage rate or APR reflects the true cost of borrowing. In a Custom Scenario you define the Adjustment Points and the amount of each adjustment. Low Fixed Mortgage Refinance Rates Updated Daily.

In order to determine your mortgage loans APR these fees are added to the original loan amount to create a new loan amount of 205000. The Best Lenders All In 1 Place. On an adjustable rate mortgage ARM however the quoted interest rate holds only for a specified period.

If your initial interest rate is equal to the index interest rate plus your margin taking into account any rounding your adjustable rate loan is fully indexedWith these types of loans you calculate the APR the same way you would with a fixed-rate loan. Backed By Reputable Lenders. Mortgage APR includes the interest rate points and fees charged by the lender.

A higher projected interest rate at the first reset. While low APRs may be a common occurrence while interest rates are low quite the opposite can happen once rates and mortgage indexes begin to creep higher. This means that the monthly payments can go up or down throughout the life of the loan.

A Rating with BBB. Yet when I look at their Truth In Lending Disclosures the APR is 4454. APR is better to compare the value of two loans.

Ad 2020s Online Mortgage Reviews. APR is higher than the interest rate because it.

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

How Much Can An Adjustable Rate Mortgage Go Up Financial Samurai

5 1 Arm Your Guide To 5 Year Adjustable Rate Mortgages Credible

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Why You Should Not Use Apr To Compare Loans Mortgage Blog

5 1 Arm Vs 30 Year Fixed What S The Better Choice And Why

What Is An Arm Loan Adjustable Rate Mortgages Zillow

What Is An Adjustable Rate Mortgage Ally

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

How Much Can An Adjustable Rate Mortgage Go Up Financial Samurai

Fixed Rate Vs Adjustable Rate Mortgage Arm Mortgage Blog

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

5 1 Arm Vs 30 Year Fixed What S The Better Choice And Why

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Post a Comment for "Gorgeous! Why Is Apr Higher On Arm Loans"